Will you emerge stronger from the next decade of volatility?

You live and breathe risk and return. You also know deep down that the world is changing and risk is changing with it.

What does regenerative investing mean for you?

Regenerative Portolio Design

The runway is shortening for investments that exacerbate social, economic, ecological and climate problems. Leading investors know this and are starting to adjust their portfolios. But ESG and impact funds are having no impact. Regenerative investing, when done right, will show who’s really ahead of the curve.

Regenerative Asset Selection

You are already battling ESG red tape. Regulatory hurdles are increasing for the companies and assets you have invested in. And still none of it is having any impact on our global challenges. So it will get worse. Regenerative assets are a different game altogether if you know how to separate the wheat from the chaff. We do.

Regenerative Governance

As the world changes, your governance stakeholders are choosing sides and jockeying for position. When institutions accept that ESG isn’t working, there will be plenty of regulatory and governance shocks that will create uncertainty and cost you money. By putting regenerative governance into practice you will be the calm amid the storm.

Regenerative Leadership Programme for Investor C-Suite and Boards

This multi-year and multi-phase programme engages leaders from the investor C-suite and Board in an intensive regenerative investing leadership development programme. It guides you and your leadership team safely, step by step, to use regeneration to achieve the thriving of your organisation, regenerative funds, individual assets and the places in which those assets are located.

The key focus is building regenerative capabilities in the leadership team which involves:

- Working with systematics and regenerative frameworks to identify and work with the organisation’s unique potential

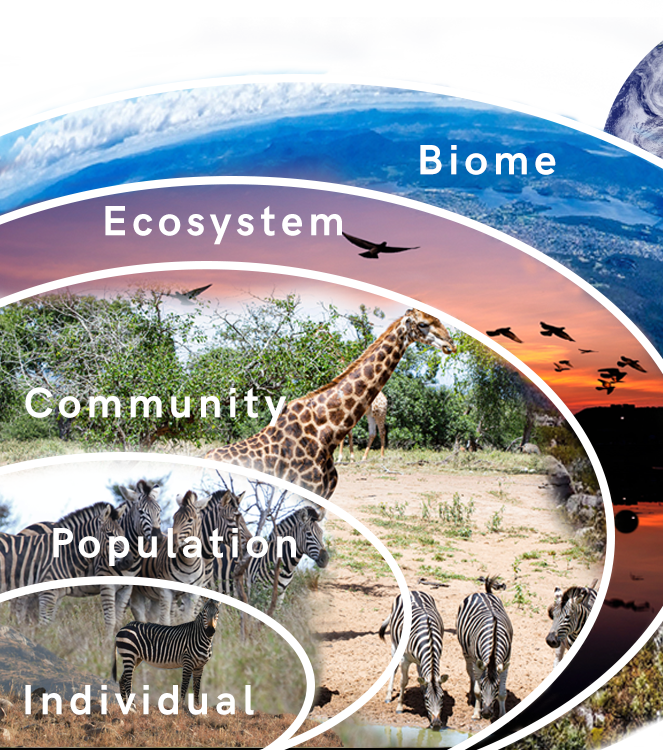

- Understanding and working with nested systems of impact

- Using living systems principles to inform investment decision making, design and development

- Developing the capability to identify and work with essence patterns which are often unseen or overlooked

- Creating powerful trust and dynamics shifts in the organisation towards healthier and more productive collaboration and greater performance

Regenerative Portfolio Design

This 24-month intensive program builds capabilities in general partners and asset managers in regenerative leadership, portfolio design and development and regenerative potential identification in individual assets – utilizing regenerative principles and over 30 frameworks in a combination of interactive workshops and immersive experiences.

We work with you at the whole portfolio level and single asset level in parallel. We start by identifying a single asset within your portfolio that has the potential and will for a regenerative transition – we get to work with you and the ecosystem of stakeholders to transition the asset to excel across economic, ecological, social and culture/heritage measures. We do this by starting with the Integral Assessment and Story of Place processes which are foundational to all regenerative work.

As the regenerative investing capabilities of you and your team grow as you work with this first asset, we then work with you to apply these capabilities to the whole portfolio to create a truly impactful regenerative fund. Applying the powerful 18 Cell Framework, we deepen the design and development capabilities for regenerative funds, portfolios and individual assets.

Regenerative Portfolio Governance

Following from the Portfolio Design Program we move into the Portfolio Governance Process. This process harnesses the recently acquired capabilities in regenerative design and development to develop and evolutionary governance framework that works with the 18 cell Framework, the 10 Regenerative Principles and Seven kinds of Capital.

This governance framework assists in identifying opportunities in the risks presented within the complexity and uncertainty of the market and within each asset to enhance impacts and returns. Working with additional regenerative frameworks we de-risk assets within the portfolio and make transparent inter-asset synergies enhancing opportunities for value capture.

Regenerative Portfolio Impact Reporting

Extending the Regenerative Governance framework to impact reporting, we implement the core of ComUnityVerse, JET’s regenerative governance and impact tool. Aligning with the Story of Place patterns of your portfolio and its individual assets, the tool allows visibility of direct economic returns in addition to the economic, ecological, social and cultural/heritage impacts generated by the asset and portfolios emergent properties across its ecosystem.

Enabling overperformance across conventional measures in UN SDGs and ESG targets, this reporting tool protects the fund from any risk of greenwashing and also makes transparent its systemic impacts generated by the asset and portfolio and sets the ground work for the a transitioning the portfolio to Net Positive.

Regenerative Asset Discovery and Information Services

How will you find candidate investable assets for your regenerative funds and portfolios? There is a small, effective global network of individuals and organisations who have the capabilities to see regenerative potential and design and develop regenerative assets, and they usually aren’t in the organisations that have the biggest marketing budgets or that are proficient in making themselves visible to the investor community.

JET’s Regenerative Asset Discovery and Information Services have done this work for you. With this offering, you gain access to a curated list of candidate regenerative assets.

Regenerative Asset Due Diligence

As you experience the power and potential of regenerative investing and start to create regenerative funds and portfolios, you will need a robust process to identify assets that are being developed in the regenerative paradigm. Many people will describe their assets as regenerative. They already are, and this will only increase. But most will be using it as no more than a selling point to investors and customers.

How will you know which assets are actually being developed from real regenerative practices?

JET’s regenerative asset due diligence is the deepest, most thorough and trustworthy process there is, created by people who are wholly committed to high-quality regenerative transitions. With this service, you will gain a sophisticated understanding of the qualities of an asset through a regenerative lens, which will also develop your own capabilities and those of your team to recognise high-quality regenerative work. This 1 month process can be done before your standard due diligence or alongside it.

Regenerative Asset Development

Through the regenerative asset due diligence, you will be able to see the areas where the asset developers have the most development to do to be able to develop the asset regeneratively. JET’s regenerative asset development programme is a multi-year programme for investors who have committed to investing in the regenerative potential of an asset and who want to sponsor the addition of more experienced regenerative practitioners to the asset development team.

Working with a single asset within your portfolio that has the potential and will for a regenerative transition – we get to work with you and the ecosystem of stakeholders to transition the asset to excel across economic, ecological, social and culture/heritage measures. We do this by starting with the Integral Assessment and Story of Place processes in the location where the asset is being developed, which are foundational to all regenerative work.

Through these processes, asset developers will engage community and other stakeholders in a way they have never experienced before. This has a profound and lasting impact on the sentiment of stakeholders to the initiative and is used as the basis for how the asset will be developed to become the source of a rich ripple effect of benefits to the place across its social, cultural, economic and ecological dimensions while meeting or exceeding your expectations on investment returns.

Regenerative Asset Governance

Following from Regenerative Asset Development, we move into the Asset Governance Process. This process harnesses the recently acquired capabilities in regenerative design and development at the asset to develop an evolutionary asset governance framework that works with the 18 cell Framework, the 10 Regenerative Principles and Seven kinds of Capital.

This governance framework assists in identifying opportunities in the risks presented within the complexity and uncertainty of the market and within each asset to enhance impacts and returns. Working with additional regenerative frameworks we de-risk assets within the portfolio and make transparent inter-asset synergies enhancing opportunities for value capture.

Regenerative Asset Impact Measurement and Reporting

Aligning with your individual assets Story of Place patterns and extending the Regenerative Governance framework to impact reporting, we implement the core of ComUnityVerse, JET’s regenerative governance and impact tool. The tool allows visibility of direct economic returns in addition to the economic, ecological, social and cultural/heritage impacts generated by the asset and portfolio’s emergent properties across the asset’s ecosystem and place.

Enabling overperformance across conventional measures in UN SDGs and ESG targets, this reporting tool protects the fund from any risk of greenwashing and also makes transparent its systemic impacts generated by the asset and sets the ground work for the asset transitioning to Net Positive.

Guiding places, investors and corporations safely through regenerative transitions.